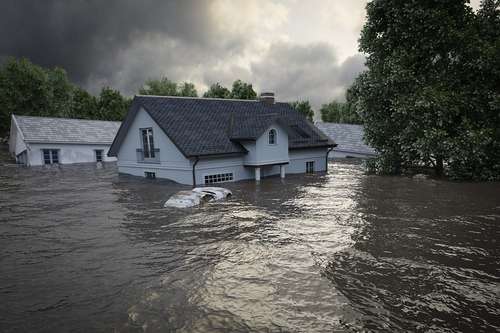

Many homeowners are surprised to learn their homeowners insurance policies don’t cover flooding events. That’s right: Most homeowners policies won’t cover flood damage.

This fact puts Utah residents—so many of whom live along the Great Salt Lake—in a tricky position. For such homeowners, adequate flood insurance isn’t optional; it’s a necessity.

How Does Typical Home Insurance Define ‘Flooding?’

If a pipe in your home busted and flooded your floor, would it be considered a “flooding event” and thus, not reimbursed by your homeowner’s policy? Or would it be covered?

We’ll never suggest unnecessary coverages, either—this we promise. We’ll give you personalized attention, designing a customized home insurance policy. We’ll take the time to review and outline every aspect of the policy and answer all your questions. From beginning to end, we deliver topnotch results.

If you answered, “Yes, this event should be covered under my home insurance policy” (or something similar), you’re correct. A flooded floor or other water damage to the home caused by a busted pipe (or even a malfunctioning appliance) would likely be covered by a typical homeowner’s insurance policy.

What kinds of events then, are classified as “flooding” and are thus not covered under a standard home insurance policy? Obviously, a heavy rainfall event wherein water rose into your home would be considered flooding.

However, other kinds of damage classified as “flood damage” under standard home insurance and flood insurance policies aren’t quite so obvious. In other words, your house doesn’t need to flood with rainwater to sustain “flood damage.” As specified in typical homeowners and flood insurance policies, flood damage also includes:

Rain Damage

Storm Surge Damage

Mud Damage

It’s a guarantee that your existing home insurance (or any home policy you’re considering for purchase) won’t cover the above events.

Where Can I Buy Flood Insurance In Ogden, Utah?

The overwhelming majority of flood insurance policies across the US—including in Utah—are sold under the National Flood Insurance Program (NFIP). The NFIP is administered by the Federal Emergency Management Agency (FEMA).

To purchase FEMA flood insurance, you must go through an NFIP-Direct-affiliated agency. Heiner’s Insurance Center has sold flood insurance through NFIP for many years.

What Type Of Flood Insurance Do I Need?

NFIP flood insurance policies come in two types:

Standard Flood Insurance

These policies are designed for residents who live in communities with an active and ongoing flood management plan. Such communities must also be able to demonstrate that they have enacted certain NFIP guidelines to reduce flood-based damages.

Preferred Risk Flood Insurance

These flood policies are designed for residents living in low-to-moderate risk zones. Such residents aren’t necessarily required to purchase flood insurance, but have this option in case they experience a small flood or even an unexpectedly large one.

Heiner’s Insurance Agency Sells FEMA Flood Insurance

If you’re shopping for flood insurance, we’d love to hear from you! As an NFIP-Direct-affiliated agency, we can help you find and purchase an appropriate flood insurance policy.

We’re glad to speak with you about flood insurance and to answer all your questions too. For a free flood insurance quote, call Heiner’s Insurance Agency today at 801-621-2620! Or go to our contact page for a free online flood insurance quote.